Our new system is now live!

You will need to RE-ENROLL in our new Online Banking system.

Follow the steps below and view the Frequently Asked Questions for details.

Our team is committed to making this transition as smooth as possible, and we're ready to assist you every step of the way.

Re-enroll in Online Banking

For enhanced security, please note these new requirements:

- Each member will create a unique login. Example: Even if you and your spouse share a joint account, each of you will create your own individual login.

- Your new username should not be your account number or social security number.

- Passwords must be 14 characters or more, requiring a mix of upper- and lower-case letters, numbers, and symbols

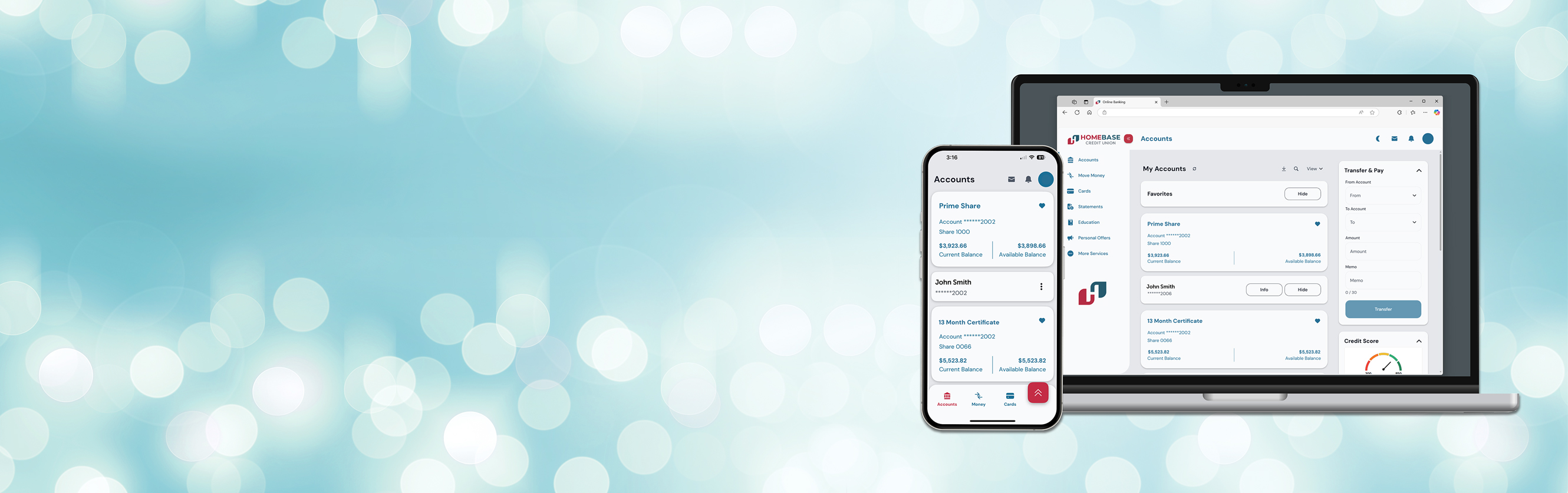

Re-enrollment can be completed on a mobile device or a desktop computer. Photos and instructions for each are below.

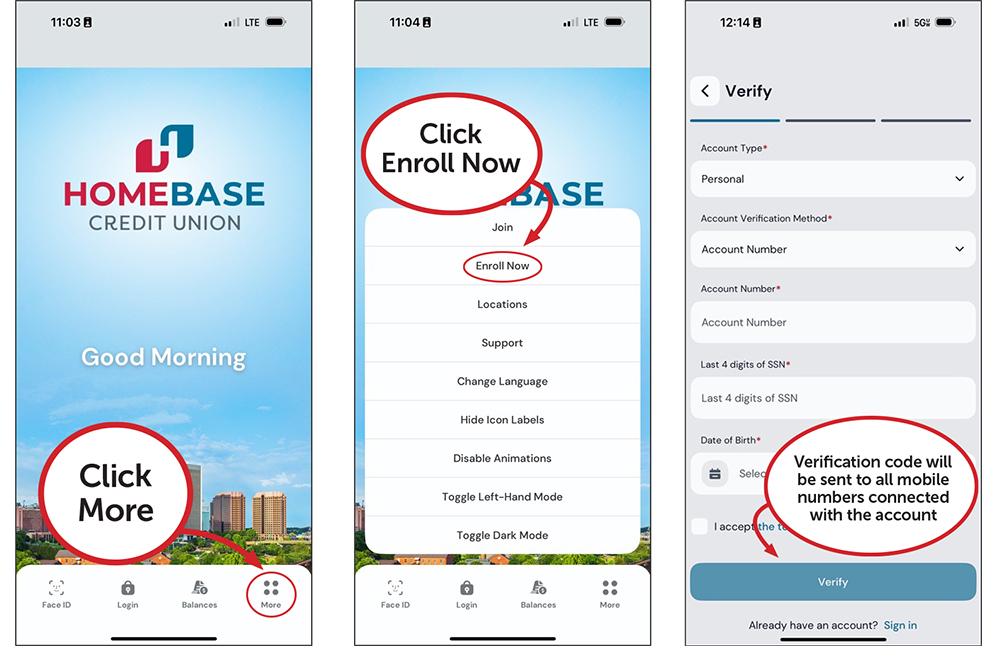

RE-ENROLL ON A MOBILE DEVICE

Apple users: app will prompt an update

Android users: download new app at Google Play store

Download our app from Apple® App Store or Google Play™ Store.

- Open the app and choose More (4 dots in lower right).

- Then choose Enroll Now from the menu.

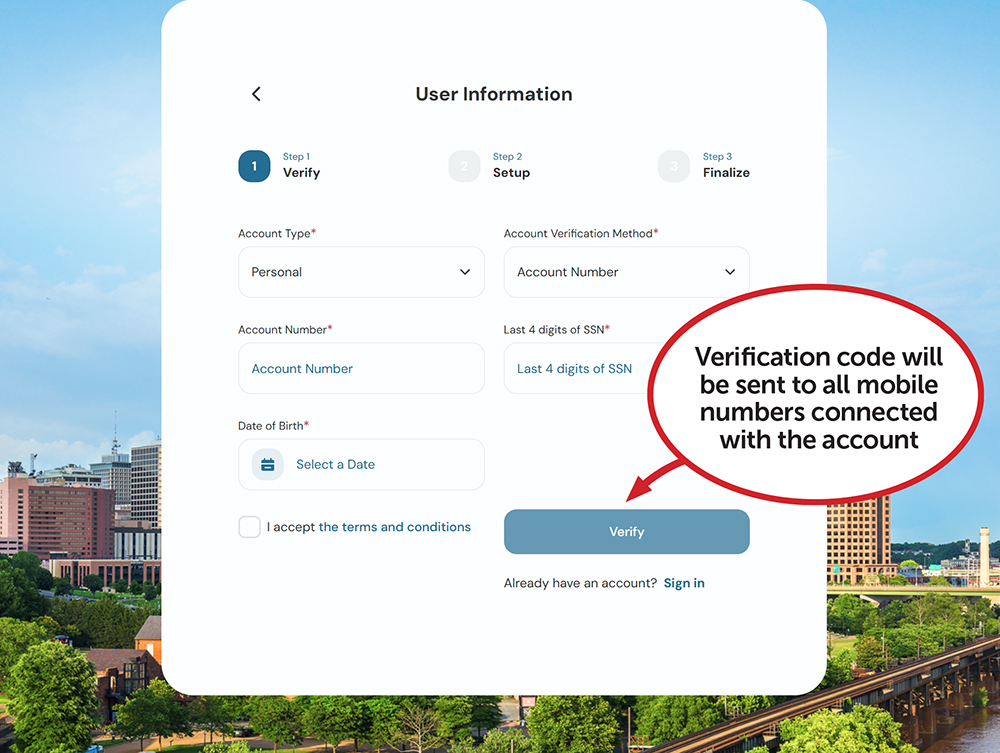

- Follow the prompts to enroll. You can choose to verify using your account number OR social security number.

- Please note: the verification code will be sent to all mobile numbers connected with the account.

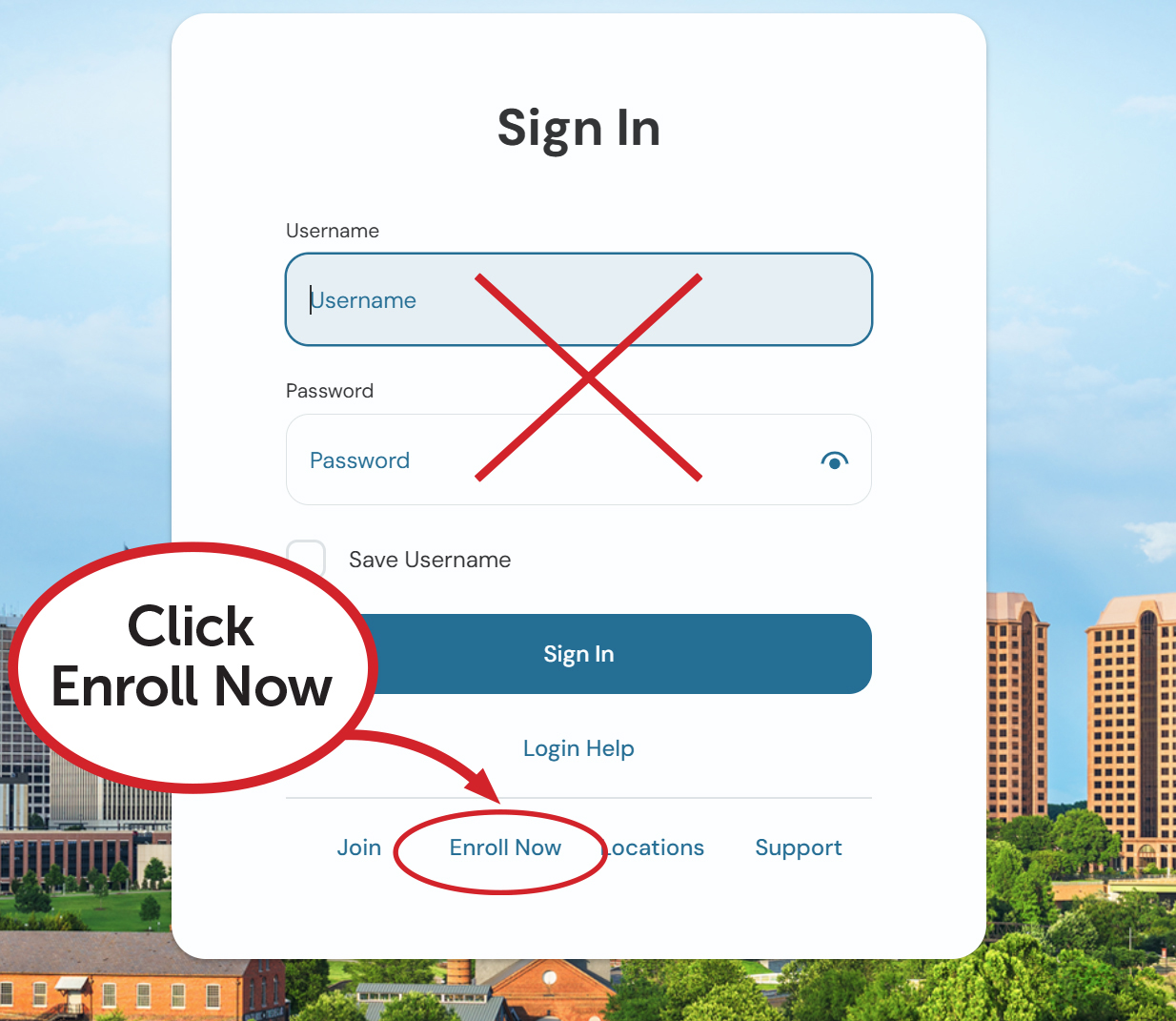

RE-ENROLL ON DESKTOP COMPUTER

- On the sign-in screen, click Enroll Now at the bottom.

- Follow the prompts to enroll. You can choose to verify using your account number OR social security number.

- Please note: the verification code will be sent to all mobile numbers connected with the account.

Questions?

If you need assistance, please contact us at (804) 452-0736.New Features

With Homebase Credit Union’s system upgrade, you will enjoy an enhanced personal banking experience. Among the key improvements are:

Mobile and Online Banking Upgrades:

- Experience an intuitive, user-friendly platform that’s simple and quick to navigate.

- All your banking transaction services are easily accessible in one digital experience.

- Enjoy the same user experience, whether you are logging in through your computer’s web browser or using our mobile app.

Improved Security Features:

- Primary and joint account holders will set up individual user logins and unique profiles

- Real-time monitoring and alerts for suspicious activity and unusual transactions

- Stay up to date on the latest fraud scams and protection practices with educational articles and videos.

Custom Alerts and Notifications:

- Set up alerts and notifications that help you stay on track with your account.

Credit Score Availability through SavvyMoney:

- Easily access your credit score and report.

- Uncover important insights into credit score factors.

- Receive personalized financial tips & recommendations.

What is staying the same?

The Homebase products, services and personal attention you know are not changing. With the technology upgrade, Homebase can offer the latest financial services while maintaining our local touch. What’s not changing:

- Your Account Numbers

- Your Debit Cards and PINs

- Your Credit Card and PIN

- Your Checks

- Branch Hours

- Homebase website (homebasecu.org)

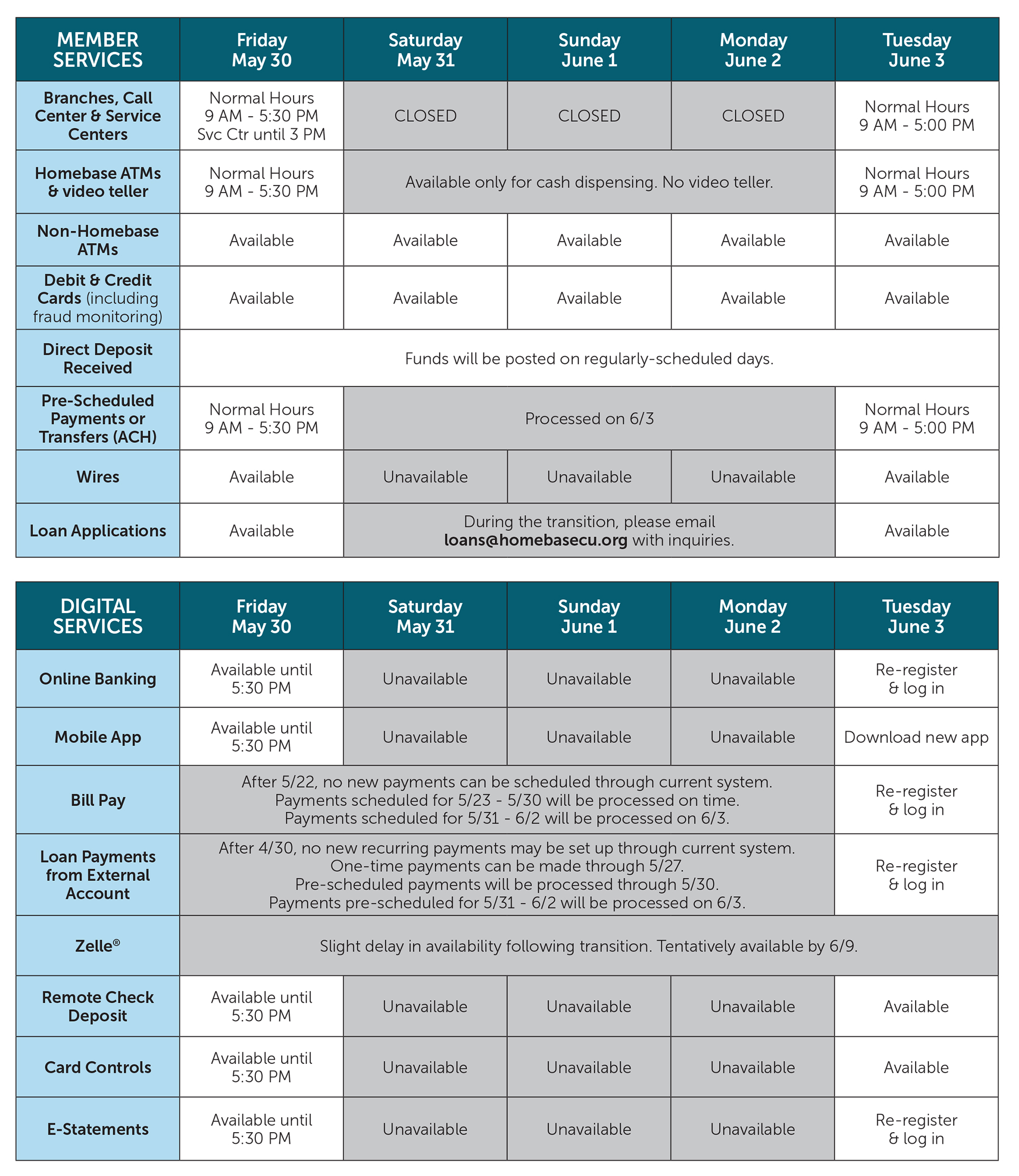

Upgrade Schedule

There are several important dates to be aware of during our system transition. Please refer to the chart below for important details and dates.

Frequently Asked Questions

GENERAL

What does a banking system do?

Our banking system is responsible for handling and storing data and transactions including:

- Opening and managing accounts

- Maintaining account holder information

- Processing and servicing loans

- Processing cash deposits and withdrawals

- Processing transactions

- Integrating with online and mobile banking platforms

Why are we upgrading our systems?

Future Opportunity & Innovation – Our new system brings better security, stability, and technology that will take us into the next generation of banking. This isn’t just an upgrade; it’s a foundation for what’s next.

Self-Service & Flexibility – Our online tools will continue to improve, giving you more control over your banking. We’ve partnered with vendors who understand our mission—not just for today, but for the future.

Efficiency & Security– our new systems will make us more efficient and reduce costs. We’ll have greater access to data to reduce fraud, strengthen member relationships, and better serve our community.

When will the system upgrade take place?

Saturday, May 31, 2025 through Monday, June 2, 2025. Please view the chart at the top of this page for details about specific service availability during the transition.

Will Homebase branches be closed during the upgrade?

Yes, our branches will be closed May 31 - June 2 (Saturday, Sunday and Monday), while we transition to the new system. Online and mobile banking will also be unavailable during this time. We will reopen with upgraded systems in place on June 3, 2025. Please view the chart at the top of this page for details about specific service availability during the transition.

Will I be notified once the upgrade is complete?

What can I do to make sure that I receive important information?

To ensure a smooth transition, please make sure your name and contact information are correct in our current Online Banking system. You can quickly check—just log in to Online Banking through a web browser (website, not the app), click “Settings”, then “Profile”. Or you can call us (804) 452-0736 to update your information.

What if I have other questions?

ONLINE & MOBILE BANKING

Will online banking and mobile banking be accessible during the system upgrade weekend?

Will I need to update my online banking credentials after the upgrade?

Yes, on Tuesday, June 3, 2025, you will need to RE-ENROLL for online banking and update your mobile app. Re-enrollment can be completed on a desktop or your phone.

- Apple users: app will prompt an update

- Android users: download new app at Google Play store

PLEASE NOTE: Each member must create a unique login. Example: Even if you and your spouse share a joint account, each of you will create your own individual login.

Will the Homebase Mobile App change?

Yes, our current mobile app will be replaced. The new Homebase mobile app will be available on Tuesday, June 3, 2025, for both Apple and Android devices.

- Apple users: app will prompt an update

- Android users: download new app at Google Play store

PLEASE NOTE: Each member must create a unique login. Example: Even if you and your spouse share a joint account, each of you will create your own individual login.

Will I need to update my online banking bookmark?

Yes, you will need to update your bookmark. Go to homebasecu.org, click on the Online Banking/Sign In button at the top right of the screen.

Will my mobile banking alerts and notifications still work?

After the upgrade, you will still be able to receive alerts and notifications, although you may need to reconfigure alert preferences within your settings.

Will my online bill payments carry over to the new system?

All scheduled bill payments will be automatically transferred to the new system. To ensure accuracy, we recommend double-checking your scheduled payments after the upgrade.

- Currently unavailable while we transition

- Payments scheduled for 5/23 – 5/30 will be processed on time

- Payments scheduled for 5/31 – 6/2 will be processed on 6/3

- On 6/3, RE-ENROLL and log in to Online Banking or the Mobile App

- VERIFY that all previously scheduled payments are still set up correctly

Will the external transfer process be different?

Yes, external transfers to/from other financial institutions will be available through our new online and mobile banking. Scheduled transfers will not carry over to the new system and will need to be rescheduled after June 3.

- Available in current system through 5/30

- On 6/3, RE-ENROLL and log in to Online Banking or the Mobile App

- RESCHEDULE all previously scheduled transfers

Can I still use Zelle in the new system?

What is the new SavvyMoney Credit Score Tool and how will it work?

Homebase is proud to partner with SavvyMoney, a tool that lets you review and monitor your credit score, access your full credit report, and get advice for improving your credit — all for free!

- Daily access to your credit score

- Real-time credit monitoring alerts

- Credit score simulator

- Personalized analysis of factors impacting your credit score

- Special credit offers

- Educational videos and financial advice

It's easy to sign up!

- On June 3, log into your Homebase online banking or mobile app.

- Click on the credit score widget.

- Provide the required information and agree to the terms (don't worry, this won't affect your credit score!)

- Explore all the great features available with SavvyMoney!

Will I still be able to export my account information to QuickBooks® or Quicken®?

Yes, transaction downloads will be available through the mobile app and online banking. Click on the download arrow next to the "My Accounts" tab.

Please note: The system upgrade requires that you make changes to QuickBooks®, Quicken® software, so please take action to ensure a smooth transition. Instructions are available below.

Deactivate-Reactivate Your Account.

Before using these services, you will need to complete the deactivation-reactivation of your online banking connection to ensure that you get your current Quicken or QuickBooks accounts set up with the new connection.

Conversion Instructions

- QuickBooks Desktop Conversion Instructions

- QuickBooks Online Conversion Instructions

- Quicken Conversion Instructions

Please carefully review your downloaded transactions after completing the migration instructions to ensure no transactions were duplicated or missed on the register.

CHECKS & DEPOSITS

Will my checks continue to be processed during the upgrade?

Checks will continue to be processed as usual. However, processing times may be slightly delayed during the transition period.

Can I still use my current Homebase checks after the upgrade?

Yes, your current checks can be used since your checking account numbers will not change.

Will I receive my direct deposit during the transition?

Will I need to update or change my direct deposit information?

No, your direct deposit information will transfer automatically.

Will mobile check deposits be available during the transition?

No, mobile check deposit will not be available during the upgrade weekend of May 31 – June 2, 2025. On June 3, 2025, remote check deposit will be available through our updated mobile app.

Is there a delay in processing deposits during the upgrade?

Processing times may be slightly delayed during the upgrade. If possible, we recommend depositing checks before the scheduled upgrade date. You also can use the night deposit at one of Homebase’s branches, and those deposits will be recorded when we reopen on June 3, 2025.

MANAGING YOUR LOANS

Will my loan payments be affected during the system upgrade?

Loan payments will continue to be processed as scheduled. However, there may be a short delay in processing times during the upgrade period. We recommend making loan payments before the planned upgrade to avoid any issues.

Will my loan details, such as interest rate and payment schedule, change after the upgrade?

No, all loan terms, including your interest rate, payment schedule and loan balance, will remain the same. The upgrade will not impact any existing loan agreements.

Can I still apply for a loan during the system upgrade?

While our online application system will be unavailable during the transition, you may email [email protected] with your inquiry and we will contact you once we reopen. Please do NOT email your member number or social security number.

Will I be able to access my loan information through online and mobile banking after the upgrade?

Yes, after the system upgrade, you will have full access to your loan information, including loan balances, payment due dates and transaction history through online and mobile banking. The new system will also provide enhanced tools for managing your loans.

What about the payments and recurring payments scheduled for future dates?

Scheduled payments will be transferred to the new system. Once you are logged into the new Homebase online environment, please review your scheduled payments and payees to ensure their presence and accuracy.

Will I still be able to make loan payments from another financial institution?

Yes. Our external payment system will be changing platforms. A few things to note:

- Payments can be made with debit card or from a checking account.

- There will still be a $7.95 convenience fee for card payments. No fee for payments from checking accounts.

- Debit card payments can be made through your Homebase online banking account.

- Checking account payments must be made through the "Make a Payment" link found at the top right of the Homebase website.

- Credit cards will no longer be accepted for loan payments.

If you notice a loan payment is missing or incorrect, contact Homebase’s loan servicing department immediately at 804-452-0736 for assistance. Our team will work with you to resolve the issue as quickly as possible.

ACCOUNT STATEMENTS

Will I still receive my monthly account statements during the system upgrade?

Yes, your monthly statements will still be delivered as usual. E-Statements will continue to be available through our new online and mobile banking system.

How far back will I be able to access my account history after the upgrade?

You will continue to have access to your transaction history for up to 18 months online. There may be a delay in past statement availability while past statements are transferred to the new system. Older statements will still be available by request.

Will my account balances reflect real-time data after the upgrade?

Yes, once the upgrade is complete, your account balances will reflect real-time data just as they do now.

ATMs & DEBIT CARDS

Will I still be able to use my debit card during the upgrade?

Debit card purchases, withdrawals and point-of-sale transactions will be available but with temporarily reduced limits from May 31 – June 2, 2025, during the upgrade weekend.

Will ATM services be available during the conversion?

ATMs will remain operational for withdrawals; however, balance inquiries may not populate with real-time data during the system upgrade. Additionally, withdrawal limits will be temporarily reduced during the upgrade weekend.

Will I get a new debit card because of the upgrade?

No, your debit card will not be changing.

Will I need to update my PIN after the upgrade?

No, your existing PIN will continue to work, and no updates are required unless you wish to change it for security purposes.

Will I still receive instant alerts for debit card transactions?

Yes, you will continue to receive transaction alerts. However, there may be brief delays in notifications during the upgrade period.

Join Now

Join Now Contact Us

Contact Us  Branches & ATMs

Branches & ATMs Become a Member

Become a Member Make a Payment

Make a Payment Branches & ATMs

Branches & ATMs Contact Us

Contact Us