24/7 Secure Digital Access

Take advantage of the online services available with your account. Login to Online Banking or the Homebase Mobile App* from your computer, tablet or smartphone when it's convenient for you. Enjoy these updated features, and more!

- Pay bills

- Deposit Checks

- Transfer to/from external accounts

- View and track your credit score

- Set controls and travel dates for your debit and credit card

- Set Alerts to track activity and spending

- Register to view your statements

- Download activity for Quicken and QuickBooks

- Apply for loans and open new accounts

Download our app from Apple® App Store or Google Play™ Store.

*Carrier rates and fees may apply.

Digital Banking Benefits

Pay Bills Online

Online Bill Pay lets you pay all your bills in one secure location. No more writing checks or making credit card payments over the phone. With just a few simple clicks, you can pay everyone, from your health care provider to your babysitter.

With Online Bill Pay, you can:

- Pay your bill anytime.

- Schedule payments in advance.

- Stop or change payments anytime.

- Schedule payments in advance.

- Add any bill quickly and easily.

- Save payee information in one secure location.

- View your payment history.

Get Started: After logging in, click on "Move Money" and then "Pay Bills"

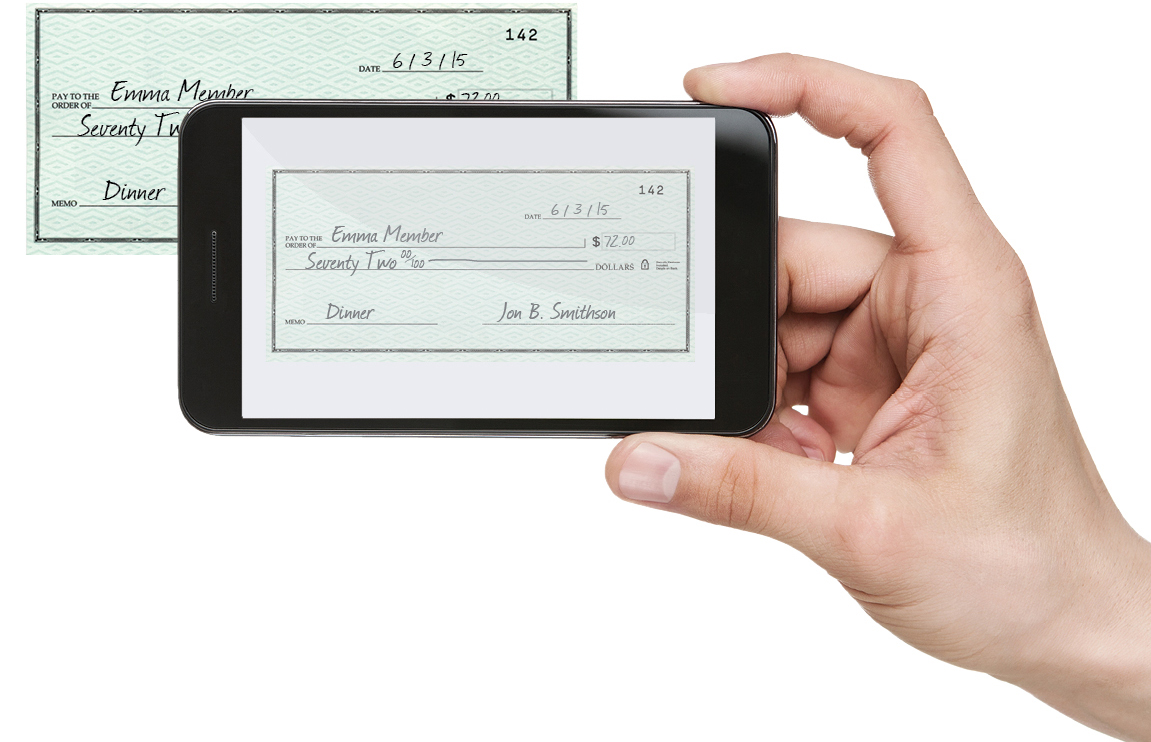

Deposit Checks Remotely

Enjoy the convenience of remote check deposits through our mobile app.*

Before taking the picture, be sure to endorse it by writing: "For E-Deposit Only at Homebase Credit Union" and endorse (sign).

When taking the picture of the check, ensure that:

- There is a strong cellular signal or Wi-Fi connection.

- All apps that use your device camera are closed.

- There is sufficient lighting and contrast between check and background surface.

- Check is on a dark surface.

- Check image is free of shadows.

- If wrinkled, flatten the check before taking the picture.

- Check image is clear and all four corners are inside the guide markers.

- You will be able to review the picture and retake it if necessary.

Please Note:

- The deposit limit is $5,000 per business day (Monday thru Friday by 3:00 PM EST, excluding Federal Reserve Holidays).

- Checks deposited before 3:00 PM EST Monday-Friday (except holidays), if accepted, may be available after 6:00 PM EST on that business day.

- Checks deposited after 3:00 PM EST on Monday-Friday (except holidays) will be processed with deposits submitted on the next business day.

- If a longer hold is required, we will contact you.

- Please ensure your contact information, including your email address, is updated with us at all times.

*Carrier rates and fees may apply.

Access eStatements

With paperless statements, you get the security and convenience of accessing your statements on your computer.

eStatements give you:

- Better security

- Faster access

- 24/7 availability on your computer

- Less paper clutter

Sign up for eStatements today!

- Log in to Online Banking

- In the menu bar, click on Statements

- Select the Account and view!

Use Mobile Wallet

Making payments is even safer when you use Apple Pay™, Google Pay™, and Samsung Pay®, the industry standards for secure payments. You can add your Homebase Credit Union Visa® debit card or Platinum Rewards Visa® credit card to the mobile wallet app on your device.*

When you complete a transaction using this method:

- Your name, card number, and security code stay private.

- You don't give your physical card to anyone.

- Your device doesn’t share your actual card numbers with retailers.

- The retailer receives only a transaction-specific code to process your payment (code changes for each transaction).

Setting up your Homebase Credit Union debit or credit card on Mobile Wallet is simple.

- For Apple Pay™, go to Apple Pay Setup

- For Google Pay™, go to Google Pay Setup

- For Samsung Pay®, go to Samsung Pay Setup

Please Note: For additional security, you will be given a number to call to verify your identity and card information during the setup process. You will need to access your account, as you will be asked to provide previous transaction amounts made on that card.

* Message and data rates may apply.

Available wherever mobile wallet payments are accepted.

Apply Pay™ is a trademark of Apple, Inc., registered in the U.S. and other countries.

Android® and Google Pay™ are trademarks of Google LLC. Samsung® and Samsung Pay® are registered trademarks of Samsung Electronics Co., Ltd. Only compatible with select cards, carriers and Samsung devices.

Set Card Controls

Manage your cards directly from the Homebase mobile app! Update your Homebase app, then tap on "Cards" in the navigation bar. Check out all the card management features, including:

- Turn your card on and off

- Report your card lost or stolen

- View debit & credit card transactions

- View credit card statements

- View digital card

- Reset your own PIN

- Set your own travel dates

- Card controls and alerts

- Get alerts on transactions

Send Money with Zelle®

As of June 9, 2025, Zelle is up and running within our online banking and mobile app. Thank you for your patience!

Zelle® is a convenient way to send and receive money with friends, family and others you trust. Whether you’re splitting the cost of a meal, gift, or trip, Zelle® makes it easy to pay your share. Over 100 million people are enrolled with Zelle®, so you can send money to friends and family even if they don't bank at Homebase Credit Union.*

Why use Zelle®?

No Fees

There are no fees to send and receive money with Zelle from the Homebase Credit Union Mobile App.

Fast

Money goes straight into your account and is available to use in minutes.*

Private

All you need is an email address or U.S. mobile number. Your account information and activity stay private.

* To send or receive money with Zelle®, both parties must have an eligible checking or savings account. Transactions between enrolled users typically occur in minutes. Carrier rates and fees may apply.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Credit Score by SavvyMoney

Staying on top of your credit has never been easier. Homebase is proud to partner with SavvyMoney, a tool that lets you review and monitor your credit score, access your full credit report, and get advice for improving your credit — all for free!

- Daily access to your credit score

- Real-time credit monitoring alerts

- Credit score simulator

- Personalized analysis of factors impacting your credit score

- Special credit offers

- Educational videos and financial advice

Ready to get started? It's easy to sign up!

- Log into your Homebase online banking or mobile app.

- Click on the credit score widget.

- Provide the required information and agree to the terms (don't worry, this won't affect your credit score!)

- Explore all the great features available with SavvyMoney!

Make External Account Transfers

Easily transfer funds to and from your accounts at other financial institutions.

- More control over your money

- Make transactions between 15,000 financial institutions via the ACH network, enabling our online banking users to take advantage of a unified, secure and easy-to-use account-to account transfer experience.

- Save time by using automatic transfers

- Make one-time transfers, recurring transfers or future-dated transfers.

Need Assistance?

We’re here to help, so reach out today. Call us at (804) 452-0736, or submit a contact request, and we’ll email you back.

You May Be Interested In

-

Remote Check Deposit

Enjoy the convenience of remote check deposit through our mobile app.Remote Deposit Details > -

Direct Deposit

We accept any recurring check for direct deposit into your checking or savings account. This includes salary, social security, retirement, pension, and more.Direct Deposit Details > -

eStatements

Make your life easier with eStatements and help to conserve our planet’s resources!Learn More About eStatements >

Join Now

Join Now Contact Us

Contact Us  Branches & ATMs

Branches & ATMs Become a Member

Become a Member Make a Payment

Make a Payment Branches & ATMs

Branches & ATMs Contact Us

Contact Us