Consolidate High-Interest Debt with a Lifestyle Loan1

Feeling weighed down by credit card debt from medical bills, unexpected expenses like car repairs and home maintenance, and other everyday purchases?

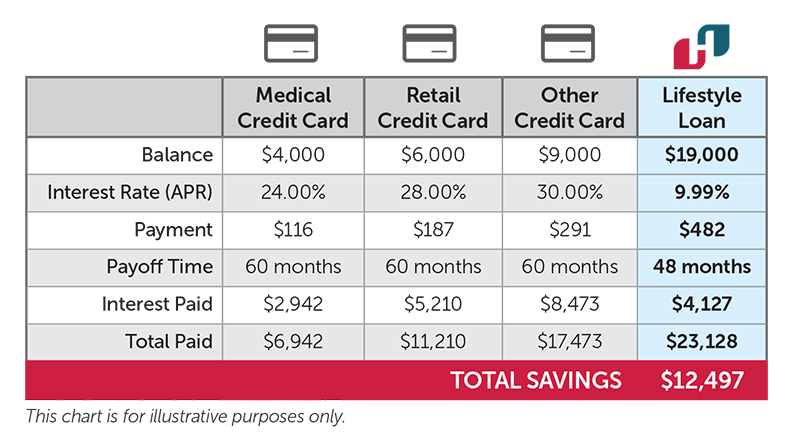

Consolidate those higher-rate balances into one convenient, lower-rate Lifestyle Loan from Homebase Credit Union. You could save THOUSANDS of dollars over the life of the loan!

Hard to believe? We’ll let the numbers tell the story:

1) Lifestyle Loans available at rates from 7.99% APR to 17.99% APR. 7.99% APR is applicable on a Lifestyle Loan for terms from 6-84 months. Terms up to 84 months available depending on amount borrowed. Advertised rate is current as of January 1, 2026, assumes excellent credit, and is subject to change. Credit qualifications apply. A loan example: $25,000 financed at 7.99% APR for 84 months gives a monthly payment of $391. This equates to $32,763 over the life of the loan. Membership required with a $25 minimum deposit and $1.00 membership fee.

Join Now

Join Now Contact Us

Contact Us  Branches & ATMs

Branches & ATMs Become a Member

Become a Member Make a Payment

Make a Payment Branches & ATMs

Branches & ATMs Contact Us

Contact Us