Consolidate High-Interest Debt with a Lifestyle Loan1

Meet James. After an unexpected surgery, he used a medical credit card to cover expenses insurance didn’t fully pay. At first, the monthly payments seemed manageable. But as time went on, late fees and high interest rates began to pile up. On top of his regular credit cards, James now had medical debt weighing him down, and the stress of juggling multiple due dates left him feeling overwhelmed.

James’s situation is all too common. Medical bills, unexpected expenses like car repairs and home maintenance, and other everyday purchases are often charged to credit cards, and debt starts to add up. This credit card debt can quickly get out of hand because of one key factor: high interest rates. Many cards carry rates far higher than other financial products. For example, paying only the minimum on a card with a 29% interest rate can mean spending more on interest than on the original charges themselves.

For people like James—and perhaps for you—consolidating debt with a personal loan can be a powerful way to regain control. By rolling multiple balances, including medical credit card debt, into one loan, you simplify your finances, reduce interest costs, and create a clear path toward becoming debt-free.

The Benefits of Consolidating Credit Card Debt

- Save Money on Interest

Personal loans typically carry lower interest rates than credit cards. Consolidating debt into a single loan can cut years off repayment and save thousands in interest, freeing up money for savings or other goals. - Predictable Repayment Schedule

Unlike credit cards, which are revolving lines of credit, personal loans have fixed repayment terms. That means you’ll know exactly when your debt will be paid off—as long as you make your payments on time. - Simplify Your Finances

Managing multiple accounts—credit cards, medical bills, and other loans—can be stressful. Consolidation combines your debts into one loan with a single monthly payment. Less juggling means fewer missed payments and more peace of mind.

Smart Tips for Success

- Avoid overspending: Consolidation only works if you commit to responsible spending.

- Stick to a budget: Track daily expenses and set limits to stay on course.

- Pay on time: Consistent payments ensure you stay on track.

What’s Next?

Like James, you can take control of your finances and break free from the cycle of high-interest debt. Consolidating with a personal loan is more than just a financial move—it’s a step toward peace of mind and long-term stability.

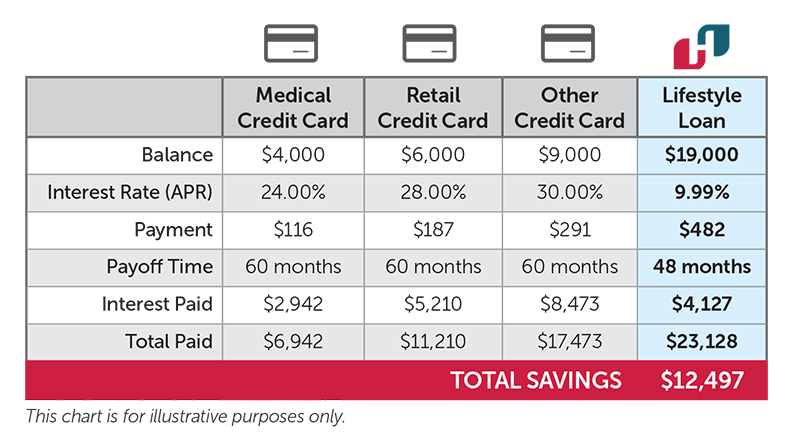

The chart below shows an example of consolidating multiple high interest cards into one lower rate Lifestyle Loan. Contact Homebase today to learn if debt consolidation is the right option for you.

$11,000 in Scholarships to Award!

We will award four merit-based scholarships to high school seniors within our membership! Applications will be available in mid-January at both branches and online. Students should complete and submit applications with letters of recommendation and transcripts by end of business Friday, March 13, 2026. Winners will be contacted in April.

Any high school senior who is a Homebase Credit Union member and entering into any area of study at a two- or four-year college/university, or pursuing a certificate or technical degree at a career or technical school is encouraged to apply. Four scholarships are available:

- One (1) award of $5,000

- Three (3) awards of $2,000 each

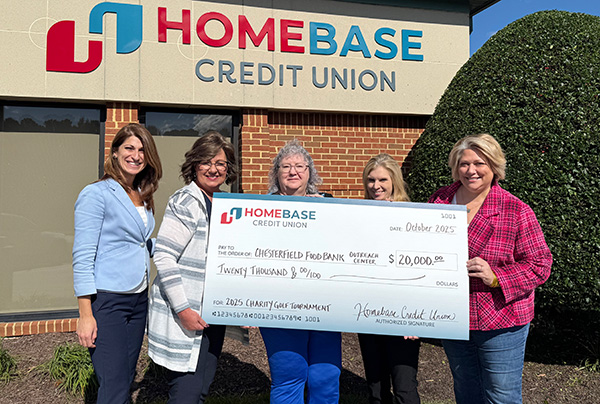

More Than $80,000 Donated to Our Community in 2025

At Homebase, giving back is at the heart of who we are. In 2025, we proudly invested in our communities through education, volunteering, and charitable support—contributing more than $80,000 in donations to local causes.

Throughout the year, our team:

- Sponsored giveaways at community events

- Led educational programs in schools and businesses

- Supported our military families

- Partnered with organizations making a difference in our service area

These efforts reflect our commitment to strengthening the places where our members live and work. Below, you’ll see highlights from some of our recent donations and activities.

IMPORTANT POLICY NOTICE

Homebase Credit Union is committed to providing all members and employees with a safe, respectful, and secure environment that upholds our core values and principles. To support this commitment, our Board of Directors has adopted a new Membership Expulsion and Limitation of Services Policy, effective March 10.

This policy outlines the expectations of membership, the definition of a member in good standing, and the process the Credit Union will follow in rare cases involving severe misconduct, fraudulent activity, or threats to staff or members.

What this means for you:

For most members, nothing changes. The policy simply ensures that the Credit Union has a clear and fair process to address serious issues when they arise. Members will always receive written notice, opportunities to respond, and clear communication regarding their rights.

The full policy is available on our website at homebasecu.org. If you have questions or would like a printed copy, stop by any branch, call us at (804) 452-0736, or email [email protected].

HOLIDAY CLOSINGS:

New Years Day: January 1

Martin Luther King Jr. Day: January 19

Washington’s Birthday: February 16

1) Lifestyle Loans available at rates from 7.99% APR to 17.99% APR. 7.99% APR is applicable on a Lifestyle Loan for terms from 6-84 months. Terms up to 84 months available depending on amount borrowed. Advertised rate is current as of January 1, 2026, assumes excellent credit, and is subject to change. Credit qualifications apply. A loan example: $25,000 financed at 7.99% APR for 84 months gives a monthly payment of $391. This equates to $32,763 over the life of the loan. Membership required with a $25 minimum deposit and $1.00 membership fee.

Join Now

Join Now Contact Us

Contact Us  Branches & ATMs

Branches & ATMs Become a Member

Become a Member Make a Payment

Make a Payment Branches & ATMs

Branches & ATMs Contact Us

Contact Us